Facts About "Investing in Real Estate? Consider an FHA Loan" Uncovered

Making best use of Your Investment Potential along with an FHA Loan

If you're in the market to acquire a house, you might be pondering what kind of car loan is greatest for you. One choice to consider is an FHA financing. This kind of lending can be a wonderful choice for numerous buyers, especially those who are first-time customers or have less-than-perfect credit.

But what precisely is an FHA car loan? And how can easily it aid you optimize your financial investment ability? Allow's take a closer appeal.

What is an FHA Loan?

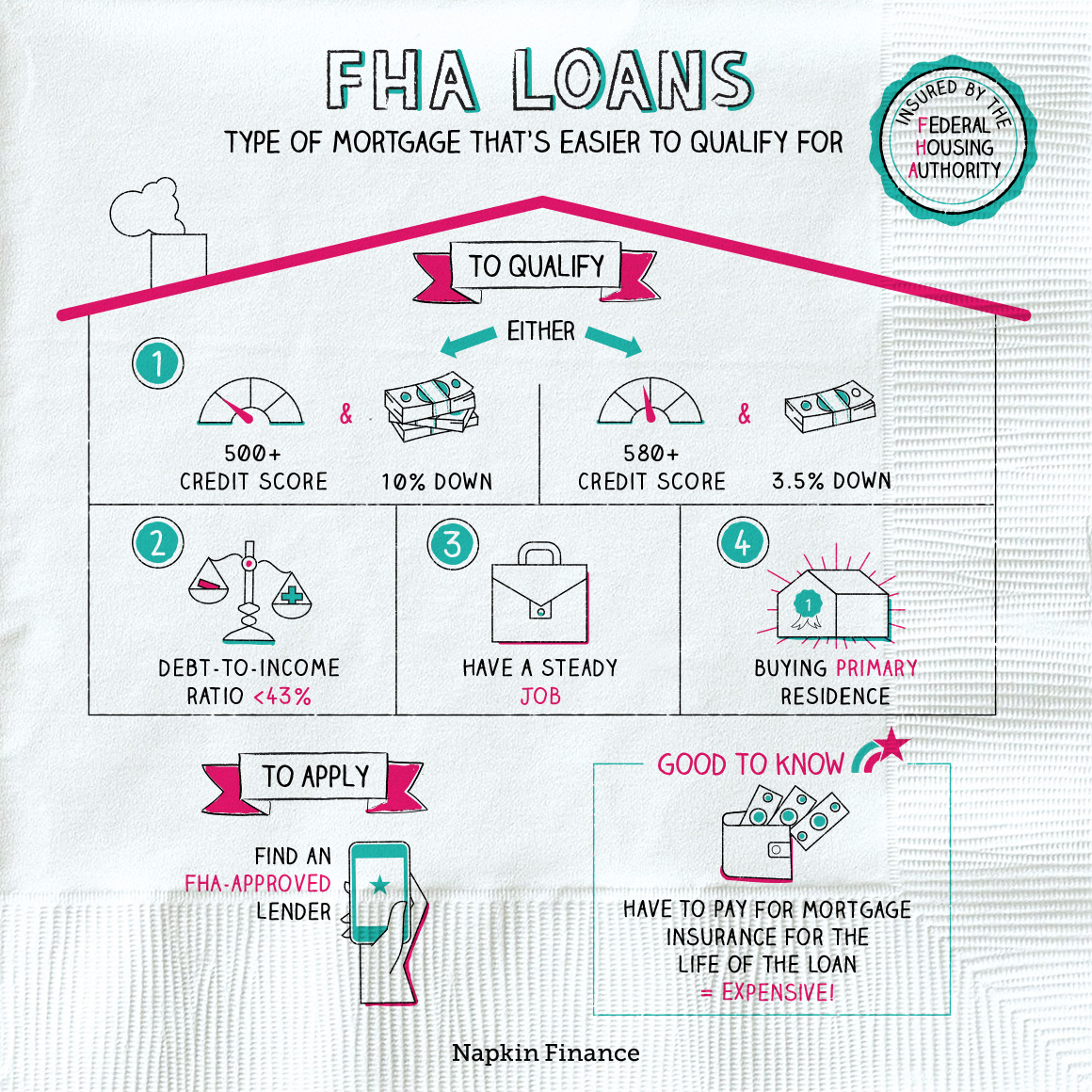

An FHA financing is a mortgage loan that's insured by the Federal Housing Administration (FHA). This means that if you default on your home loan settlements, the FHA will pay for your financial institution back. Because the risk to lenders is lower with an FHA finance, they're often even more prepared to give this style of home loan to shoppers who might not train for regular fundings.

FHA lendings come with some special advantages that can produce them a wonderful selection for certain shoppers. For can i get a 203k loan on an investment property :

- Reduce down repayment requirements: With an FHA financing, you might be capable to put down as little as 3.5% of the acquisition rate.

- Much easier credit history demands: Because the federal government guarantees these fundings, creditors are frequently more ready to function along with debtors who have lower credit score ratings or various other monetary problem.

- Extra flexible revenue requirements: You don't need to have to possess a best debt-to-income ratio (DTI) to qualify for an FHA financing.

- Reduced rate of interest fees: Because creditors face less threat with these fundings, they might supply lesser enthusiasm fees than they would on typical mortgages.

All of these benefits may help make it easier and even more inexpensive for shoppers to acquire properties they enjoy and develop capital over time.

How May You Make the most of Your Investment Potential along with an FHA Loan?

So how may you use an FHA financing purposefully to make the most of your investment capacity? Below are some recommendations:

1. Concentrate on area

One technique to make certain you're making a smart assets is to concentrate on site. Look for homes in up-and-coming areas that are probably to appreciate in market value over time. Through deciding on a residence in a desirable area, you may enhance your chances of building equity rapidly.

2. Take into consideration fixer-uppers

An additional means to take full advantage of your expenditure potential is to look at fixer-uppers. With an FHA 203k finance, you may pay for the expense of repair services and remodellings into your home mortgage. This indicates you can acquire a house that need to have some job and transform it into your aspiration home over time.

3. Strategy for the lengthy condition

Lastly, remember that getting a property is a long-term expenditure. If you're planning to market the residence within just a handful of years, an FHA loan may not be the greatest selection for you. But if you plan to live in the house for several years and create equity over opportunity, an FHA funding may be an outstanding tool to help you arrive at your objectives.

Conclusion

An FHA loan may be an outstanding option for purchasers who prefer to make the most of their financial investment possibility while appreciating extra versatile demands than they would along with standard finances. Through centering on place, thinking about fixer-uppers, and preparing for the lengthy term, you may utilize this style of mortgage smartly and build capital over time.

If you're interested in learning more regarding FHA car loans or various other types of home loans that may be appropriate for you, talk to a home mortgage finance company or financial consultant today. With the best tools and advice, you can create wise choices about acquiring a house that will certainly help established you up for monetary results in the future.